In This Issue:

In This Issue:

- CMS Invited to Explain Benefits

- Monumental Vote But Still Polarizing Issue

- Projections of State Revenue Raised

- State Pays All of Last Year’s Bills

- Extra Revenue Stimulates Desire for Spending

- Other Bills of Interest

- Report Offers Solutions to Preterm Birth in IL

Veterans Day was designated to remember the end of a world conflict but has evolved into an opportunity to thank people who serve in the armed forces and defend our freedoms. I had the honor of speaking at Hinckley Big Rock High School and can be seen with Superintendent Travis McGuire and Principal Jay Brickman. My message to the youth was take advantage of school and be prepared mentally, morally and physically for life. The Department of Defense reports 75 percent of 17- to 24-year-olds are ineligible to serve in the armed forces due to inadequate education, a criminal record or being overweight. We cannot sit on the sidelines if we want to preserve our democracy.

CMS Invited to Explain Benefits

Retired state employees will have an opportunity to hear details and ask questions about their new healthcare plan options from Central Management Services (CMS) at a seminar in DeKalb on November 18. I invited CMS staff to explain the plan after receiving numerous questions and concerns from retired university and state employees, and teachers.

The General Assembly approved legislation in 2011 changing state retiree healthcare but allowed the Governor and the state’s largest union to negotiate details. CMS has developed the plan and is just now sharing details. Retirees must make a selection among the plan’s options during the enrollment period of November 12 through December 13. Efforts to extend the deadline were not successful.

The seminar will be held Monday November 18 at Northern Illinois University’s Carl Sandburg Auditorium. The first session begins at 9:30 a.m. and will be repeated at 1:30 p.m. The auditorium is located in the Holmes Student Center at 340 Carroll Avenue, DeKalb.

Monumental Vote But Still Polarizing Issue

Traditions and attitudes are often slow to change but the vote in the House last week assures that the traditional definition of marriage is changing. Illinois will join slightly more than a dozen states that recognize same sex marriages. The two and a half hour floor debate was calm and respectful, but very passionate.

The vote and debate demonstrated the nearly equal split in our state over this issue. The arguments are now well known but unconvincing to the other side. The Supreme Court set the stage for this outcome with its ruling on the traditional definition of marriage between a man and a woman. While Illinois’ Civil Union law provides equal treatment for same sex and opposite sex couples, federal law does not. Our Illinois constitution and laws do not tolerate discrimination so the definition of marriage was in conflict.

This issue again illustrates the strength of our democracy where the majority will prevails but differing opinions are respected. The family is a key component of our society and our government should do everything possible to support it.

Projections of State Revenue Raised

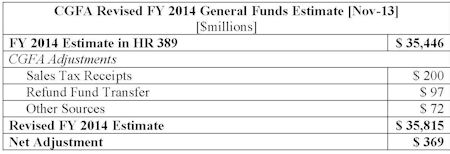

The Legislature’s Commission on Government Forecasting and Accountability (COGFA) has raised its estimate of FY14 state revenue by $369 million. Based on receipts in the first third of the year, COGFA now pegs general state revenue will total $35.815 billion.

One of the contributing factors to the revised estimate was strong sales tax receipts. Perhaps signaling renewed consumer confidence, sales tax receipts have outpaced previous estimates and were revised upward by $200 million for the year.

Reserves for income tax refunds were reduced in the budget but claims have been smaller than estimated. As a result, an extra $97 million was transferred to general revenue. Finally, court settlements have added $72 million to expected state receipts.

The chart below gives a clear picture of the revised revenue estimate.

The revenue picture may be revised upward again by early March. Through October, both personal and corporate income taxes collected have totaled more than estimated. It’s still too early to assume this trend will continue for the balance of the fiscal year.

The revenue picture may be revised upward again by early March. Through October, both personal and corporate income taxes collected have totaled more than estimated. It’s still too early to assume this trend will continue for the balance of the fiscal year.

State Pays All of Last Year’s Bills

The Comptroller reports not only have all the bills from the last fiscal year been paid, but also they have been paid the earliest since 2009. This was made possible due to stronger first quarter revenues and bills being reported to the Comptroller in a timelier manner. Normally the legislature allows bills to be paid up to 3 months following the close of the prior fiscal year but in recent years that lapse period has extended to 6 months.

Unpaid bills in the current fiscal year total about $7.5 billion. I hope the unanticipated revenue will be used to pay off these bills even earlier next year but I worry about the temptation to increase government spending. As you will see in the next story, there is movement for supplemental spending.

Rest assured that I will continue fighting for fiscal responsibility and relief for families struggling with high taxes. Our spending priorities should be placed in programs that reflect a caring, educated society and support a growing economy.

Extra Revenue Stimulates Desire for Spending

The Governor’s Office of Management and Budget worked for weeks to craft a supplemental spending bill to use the hundreds of millions of dollars in unanticipated general state revenue. What passed the legislature last week, however, was only a $50 million dollar expansion that used mostly other state funds and federal funds not General Revenue Funds.

HB209 authorized $37 million in spending from other state funds which will mostly be used to implement the concealed carry law. Other authorizations included $12 million in federal funds for social security payments, and women and child health programs. The only General Revenue Fund spending was for the Court of Claims to pay damage awards.

Other Bills of Interest

Dozens of bills passed in the Veto Session but here are a few of the more important pieces of legislation.

SB 1523 reduces the unfunded pension liability for the Chicago Park District. This bill was negotiated by all affected parties and includes increased employee and employer contributions, higher property taxes, and a reduction in the cost of living adjustment among other features. This combination is designed to bring the pension to a 90% funding ratio by 2050. The measure passed the house and senate and may be a template for a state pension bill.

SB 2196 was the initiative of the state universities to make adjustments in the civil service act, remove the 18 week limit on some university retirees returning to work, and clarification of which tier employees are in when they migrate to a different pension system.

The bill was amended in committee with a provision restricting the University of Illinois School of Labor and Employment Relations from merging with the school of business. This micro-managing of the University of Illinois by the legislature is a clear example of government over-reaching.

SB 1448 was gutted and inserted with language giving Univar the enhanced EDGE tax credit. Univar is a large chemical company planning to relocate from Washington State to Downers Grove bringing 70 executive level jobs if they get the credit. The original bill was one I have been working on for years to create the Endow Illinois tax credit for taxpayer contributions to a permanent endowment fund at a community foundation. It’s a good idea that has created millions of dollars in annual funding for non-profit organizations in other states.

Report Offers Solutions for Preterm Birth in Illinois

The Premature Infant Health Network sponsored a reception I attended in Springfield last week to announce recommendations to reduce preterm births and resulting health consequences. Each year over 21,000 infants are born prematurely in Illinois and face such risks as respiratory problems, learning disabilities, neurological problems, and vision and hearing loss. The annual societal burden associated with preterm births runs over $51,000 per birth.

The solutions according to a task force created by House Joint Resolution 111 include eliminating elective deliveries before 39 weeks gestational age, and identifying and providing enhanced care for Medicaid-eligible women at risk of adverse pregnancies. Other recommendations include well-woman care strategies, linking data systems to provide more information about premature births, and increase availability of prenatal care in communities with a high risk of premature births.

The Premature Infant Health Network is working with the March of Dimes to increase awareness among health providers for the risks of preterm births, reduce the preterm birth rate and the implementation of the report’s recommendations.

Finally, I am working to increase my presence on Facebook and ask that you “Like” my state Facebook page. This page will keep you updated on our Springfield and district activities as well as my views on current issues. You can like the page here or by clicking on the Facebook icon in the right-hand sidebar. Thank you for participating and staying connected!

Click Here To Submit A News Tip Or Story