It’s refund season! Literally. We have seen among the conversations on our Facebook page that many H&R Block clients were given a “direct deposit” date of Jan. 30 by the IRS. We couldn’t be happier for you.

However, between when that date was communicated on Wednesday (Jan. 28) and now, there has been much speculation that H&R Block Bank has already received the refund money and is deliberately “holding” it. Some even allege that the bank is earning interest off your refund amount.

Both of those are absolutely untrue.

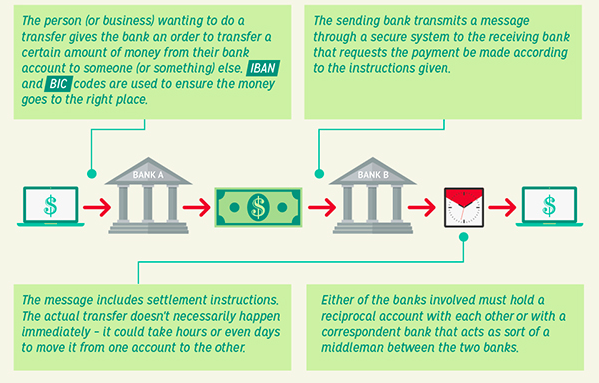

However, it’s hard to explain the process in a quick sentence. At the heart of it is how our electronic banking system works. This is something we explored in an infographic late last year.

Here’s the gist: The IRS approves your refund. It notifies the bank you selected (H&R Block Bank in the case of using a Refund Anticipation Check or Emerald Card) that it will be sending a payment. This message includes the amount of the payment and instructions for how it should be settled. The bank may update your account to reflect that this payment is “pending” – or is coming soon. A “pending” status does not mean the bank has actually received the funds. It could take hours or even days for the money to be transferred and made available for your use. That’s why it’s always very important to ensure you have the funds before attempting to use them.

We appreciate you choosing H&R Block for your tax preparation and money management, and we hope that this helps explain the refund payment issue.

Click Here To Submit A News Tip Or Story