Observations and comments about state government by State Representative Robert W. Pritchard.

May 20, 2013

In this issue:

· Pension Cost Shift for Higher Education

· Federal Flood Declaration Offers Compensation

· Illinois Still Lags in Employment Recovery

· Report Shows Majority of State Road Funds Not Going to Road Projects

· Agreement Reached on Fracking Bill

· Budget Bills to Emerge This Week

· Safety Board Recommends Lowering Drinking/Driving Limit

· DuPage County Seeks to Reduce Units of Government

· Rockford Sports Facility Funding Bill Goes to Governor

· State to Shift Costs to Local Units of Government Fund

Pension Cost Shift for Higher Education

Representatives of public universities and community colleges testified in a special House hearing last week about the terms under which they could accept a shift in paying the annual cost of pensions. Those conditions are now being drafted into legislation which the House will probably act upon this week. Many believe these same conditions will be imposed upon elementary and secondary schools as well.

Shifting the cost of annual pension payments from the state to the local employer has been a goal of Speaker Madigan for over two years and one that I support in principal. Madigan believes the entity that sets the employee’s salary should also pay the pension cost. This is also a reasonable safeguard for employees that the pension payment will be made—something the state rarely does.

The higher education institutions asked for full funding of the appropriations for education to make the cost shift less impactful on operations. The Speaker was not willing to commit future legislatures to that condition. Instead the costs will be shifted beginning in fiscal year 2015 at the rate of half a percent per year until the institutions pay the employer’s share of the pension cost. Any future pension benefit changes made by the legislature will have to be approved by the local employer and the State University Retirement System (SURS) board.

The higher education institutions asked for full funding of the appropriations for education to make the cost shift less impactful on operations. The Speaker was not willing to commit future legislatures to that condition. Instead the costs will be shifted beginning in fiscal year 2015 at the rate of half a percent per year until the institutions pay the employer’s share of the pension cost. Any future pension benefit changes made by the legislature will have to be approved by the local employer and the State University Retirement System (SURS) board.

The institutions will also get a voice on the SURS board. The current 11-member board would become a 12-member board with the chairperson elected by a majority of the board. Membership would include 3 elected by universities, 3 elected by community colleges, 4 elected by active members and 2 elected by retirees.

The higher education representatives also asked for relief from certain state mandates which is being drafted in separate legislation. I discussed the pension issue with Sandy Flood, shown at right, who is a union representative for many Northern Illinois University employees.

Speaker Madigan also wants to shift the pension costs to local school districts but apparently has yet to meet with representatives about the terms. I have had conversations with school superintendents from my K-12 districts about conditions that would make the shift less painful for them. Like higher education, K-12 school districts have received signification cuts in state funding over the last decade and would have to make additional staffing cuts if pension costs are shifted to schools without some relief from mandates or access to more revenue.

Federal Flood Declaration Offers Compensation

Those who suffered losses from the April flood event can now apply for federal assistance. Eligible residents and business owners can begin the application process by registering online at www.DisasterAssistance.gov, or by calling 1-800-621-FEMA (3362). Last week the President declared a major disaster exists in the State of Illinois and ordered federal aid to supplement state and local recovery efforts in counties that were severely impacted by the flooding. Further information is available from the DeKalb County and Kane County Emergency Management Agency in DeKalb or Geneva.

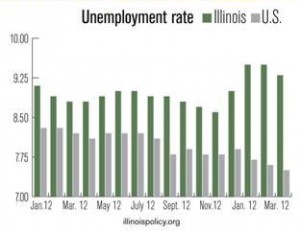

Illinois Still Lags in Employment Recovery

The Illinois Department of Employment Security has reported that the April unemployment rate in Illinois fell to 9.3 percent from 9.5 percent in March. While this is cause for cautious optimism, Illinois still lags significantly behind the national average for unemployment of 7.5 percent. Part of the reason for this lag is the fiscal condition and regulatory environment of our state.

The Illinois Department of Employment Security has reported that the April unemployment rate in Illinois fell to 9.3 percent from 9.5 percent in March. While this is cause for cautious optimism, Illinois still lags significantly behind the national average for unemployment of 7.5 percent. Part of the reason for this lag is the fiscal condition and regulatory environment of our state.

My Republican colleagues and I have introduced legislation to strengthen workers’ compensation requirements, reduce or eliminate fraud within the system and lower the cost of employing workers but the Speaker will not let them be debated. I struggle to understand why these bills would not have wide bipartisan support. We need to put people back to work and create jobs, jobs, jobs but the legislature is absent, as shown here, in the debate.

My Republican colleagues and I have introduced legislation to strengthen workers’ compensation requirements, reduce or eliminate fraud within the system and lower the cost of employing workers but the Speaker will not let them be debated. I struggle to understand why these bills would not have wide bipartisan support. We need to put people back to work and create jobs, jobs, jobs but the legislature is absent, as shown here, in the debate.

Report Shows Majority of State Road Funds Not Going to Road Projects

A report issued last week by Illinois Auditor General William Holland found that less than half of the money allocated to the state road fund was actually used for road construction. The report showed that the majority of the funds instead were used to pay salaries at the Illinois Department of Transportation, for bond debt payments and for other indirect costs.

This is not a one-year trend. In fact, the report stated that in eight of the last 10 fiscal years, less than half of the road fund expenditures went for direct road construction, for the architectural and engineering fees that accompany the projects, or for repair and maintenance of roads. According to the report, pension contributions accounted for 8.2 percent of the expenditures.

The Illinois Chamber of Commerce and the road construction industry are calling for more funding of road projects through a shift in tax revenue and bonding for a small capital project every year.

Agreement Reached on Fracking Bill

House Bill 2615 appears to finally be heading for a vote in the House. After being introduced in February with strong bipartisan support and more than 50 House sponsors, the bill was derailed over union hiring provisions. Under the compromise reached last week, companies will instead receive a break in their extraction taxes if more than half of their workers are from Illinois and are receiving prevailing (union) wages.

Fracking (or hydraulic fracturing) uses high-pressure mixtures of water, sand and chemicals to crack rock formations deep underground and release oil and natural gas. Illinois’ regulatory bill has been touted as the toughest in the nation with provisions that include holding drillers liable for water pollution and requiring them to publicly disclose the chemicals they use. Governor Quinn has promised to sign the bill with its promise of significant new state revenue.

Budget Bills to Emerge This Week

With only two weeks left until legislative adjournment, the five House appropriation committees are expected to reach recommended spending levels for FY2014 this week. The committees have been working for weeks to set priorities for spending the estimated $35.081 billion in FY2014 revenue, which is $1.3 billion more than budgeted this year. The task sounds easy, however funding requests–including pension payments, medical costs, worker pay and program expansions—are several times that number.

With only two weeks left until legislative adjournment, the five House appropriation committees are expected to reach recommended spending levels for FY2014 this week. The committees have been working for weeks to set priorities for spending the estimated $35.081 billion in FY2014 revenue, which is $1.3 billion more than budgeted this year. The task sounds easy, however funding requests–including pension payments, medical costs, worker pay and program expansions—are several times that number.

The two education appropriation committees alone have been given $85 million less than last year’s allocation. I met with representatives of the Community Coordinated Child Care (4C) Program and early childhood centers in DeKalb and Sycamore last week to hear about the results of investments in early childhood education. They presented me with bouquets of paper flowers, each representing a unique story about the importance of early education for a child.

Safety Board Recommends Lowering Drinking/Driving Limit

The National Transportation and Safety Board recommends that states lower the legal blood alcohol level for driving from .08 to .05. Illinois has used the .08 legal limit since 1997; a limit that equals about four drinks in an hour for a 170-pound male. Secretary of State White said he wants to study the recommendation.

Illinois’ Driving Under the Influence statistics provide a convincing argument for at least examining a decrease in the legal blood alcohol limit. According to the Secretary of State’s Office there were 279 alcohol-related deaths on Illinois roads in 2011 which accounted for 35 percent of Illinois’ crash fatalities. The number of DUI arrests has been declining for the past three years, and totaled 38,704 DUI arrests in 2012.

DuPage County Seeks to Reduce Units of Government

A bill that may be a model for reducing the number of units of local government passed the House last week and now heads to the Governor. SB494 will allow the DuPage County Board to eliminate duplicative or inefficient units of government where the board members are appointed rather than elected. The bill excludes fire protection districts that have full time employees and the DuPage County Water Commission.

DuPage County currently has more than 400 units of local government with many having non-elected boards. The bill requires DuPage County to engage in an audit of the unit of government, and if the findings suggest redundancy or inefficiency, the County Board could adopt an ordinance to dissolve the unit. The bill also provides the voting public with an avenue for stopping the dissolution of a unit of government. The functions of the unit of government would be consolidated by the county board with another department or unit of government.

Rockford Sports Facility Funding Bill Goes to Governor

After months of negotiations, a bill cleared the General Assembly to allow up to an additional 2 percent hotel/motel tax in the Rockford area to fund the modernization and expansion of their sports facilities. Senate Bill 1859 allows a funding stream for a $40 million Rockford Park District/Rockford Convention and Visitors Bureau project.

Improvements would add additional recreational space for basketball and volleyball arenas, fields for soccer, softball, rugby and lacrosse, and a skate park. Money from the tax would be channeled to the newly-created Winnebago County Tourism Facility Board that will manage the project. The sports facility improvements will help sustain and expand tourism activities.

State to Shift Costs to Local Units of Government Fund

Like a snow ball rolling downhill, SB492 is gaining amendments to transfer certain program costs to the Personal Property Tax Replacement Fund (PPTR) intended for local units of government. The bill started out to transfer just the costs for salaries, stipends and additional compensation for chief election clerks, county clerks and county recorders.

As the various Appropriation Committees struggle to balance their budgets, they are seeking ways to transfer expenses to other budgets and the PPTR has become a target. Among the possible amendments to SB492 is one shifting the costs associated with Regional Offices of Education and Educational Service Centers. Other committees may try to follow this practice this week and I will be watching this bill closely.

The 1970 Illinois Constitution directed the legislature to abolish business personal property taxes and replace the revenue lost to local government units and school districts. In 1979 a law was enacted creating a tax on corporations, partnerships, trusts, S corporations and public utilities which would be deposited in the PPTR Fund.

District Office 815-748-3494 or E-Mail to bob@pritchardstaterep.com

Click Here To Submit A News Tip Or Story